The income from the ordinary operations of Tampere University totalled EUR 345.2 million. The sum covers all income and expenses accrued for the financial year from the university’s research, education, and societal interaction activities.

The income from the ordinary operations of Tampere University totalled EUR 345.2 million.

Government funding decreased, external funding and other income rose

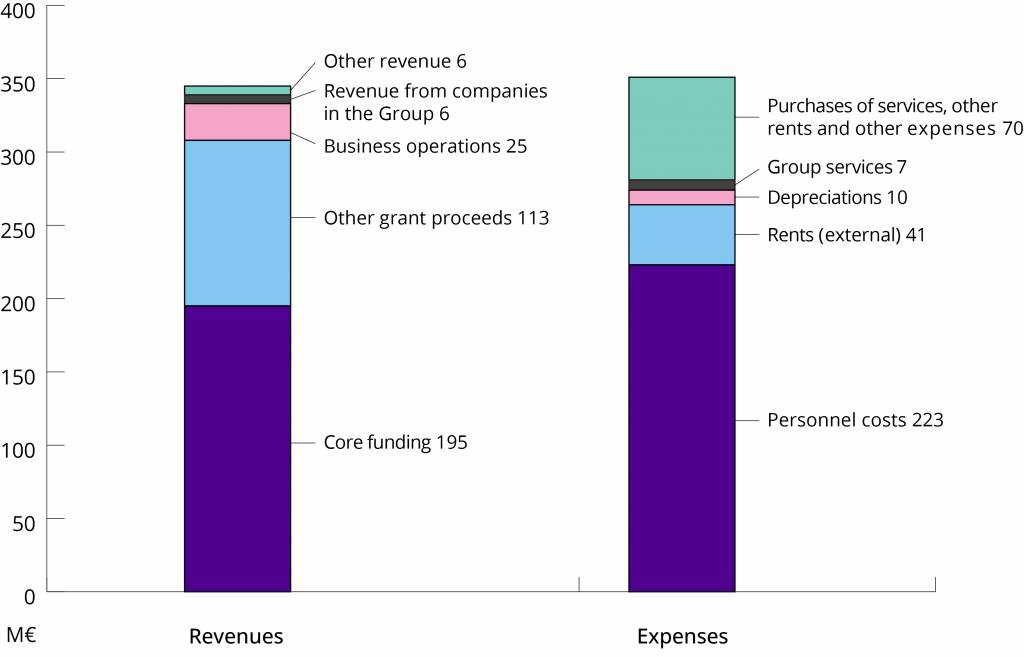

The government funding received from the Ministry of Education and Culture decreased by EUR 2.6 million from the previous year, being EUR 195 million. There was a decrease in indicator-based and strategy financing. Programme funding – especially for additional entrant places in the context of raising the educational level nationally – increased.

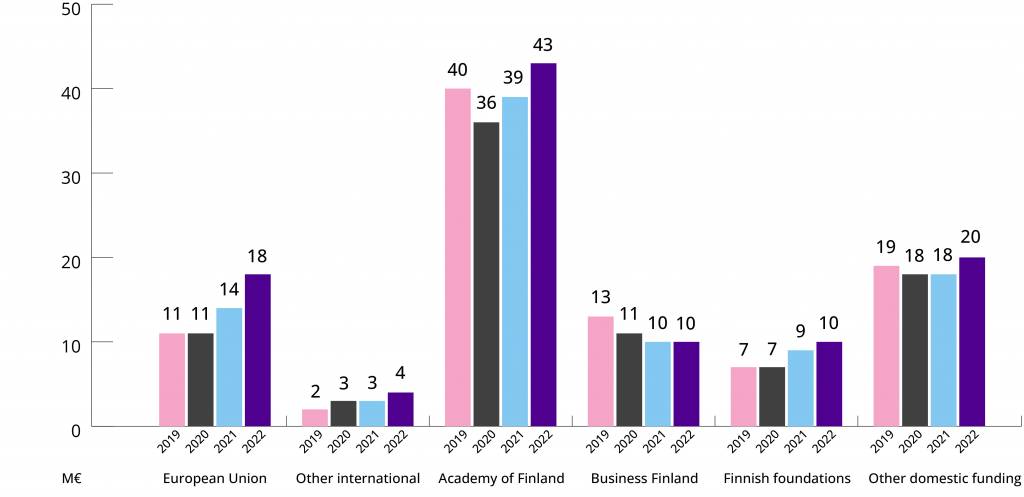

The University’s external funding and other income rose to a total of EUR 150.2 million from the previous year’s EUR 138.2 million. The most significant sources of external funding were the Academy of Finland (EUR 43.4 million), European Union (EUR 17.5 million), Business Finland (EUR 10 million) and domestic foundations (EUR 10.1 million). The transfer of vaccine testing business operations to Finvac Ltd, a joint special assignment company of the State of Finland and the Tampere University Foundation sr, generated a non-recurring item of EUR 4.1 million.

The University’s external funding and other income rose to a total of EUR 150.2 million from the previous year’s EUR 138.2 million.

Competitive research funding 2019–2022 (M€)

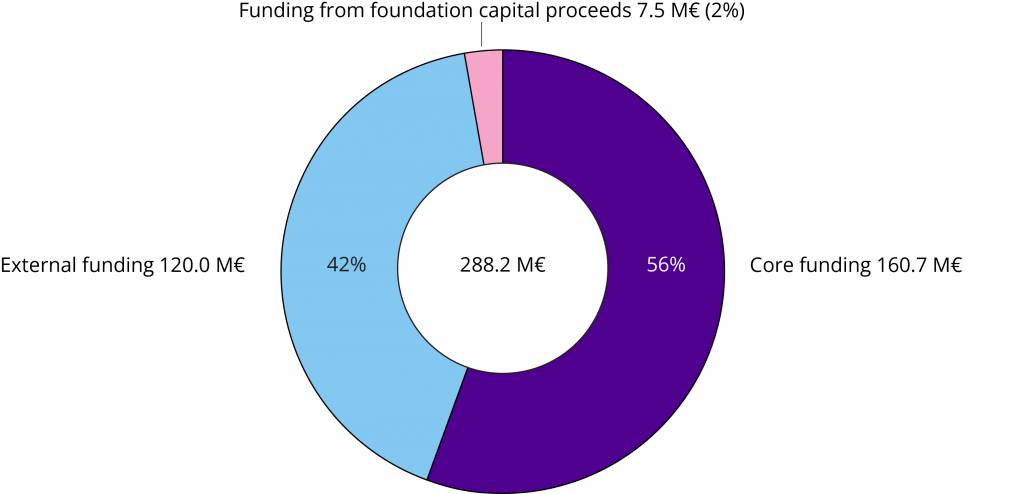

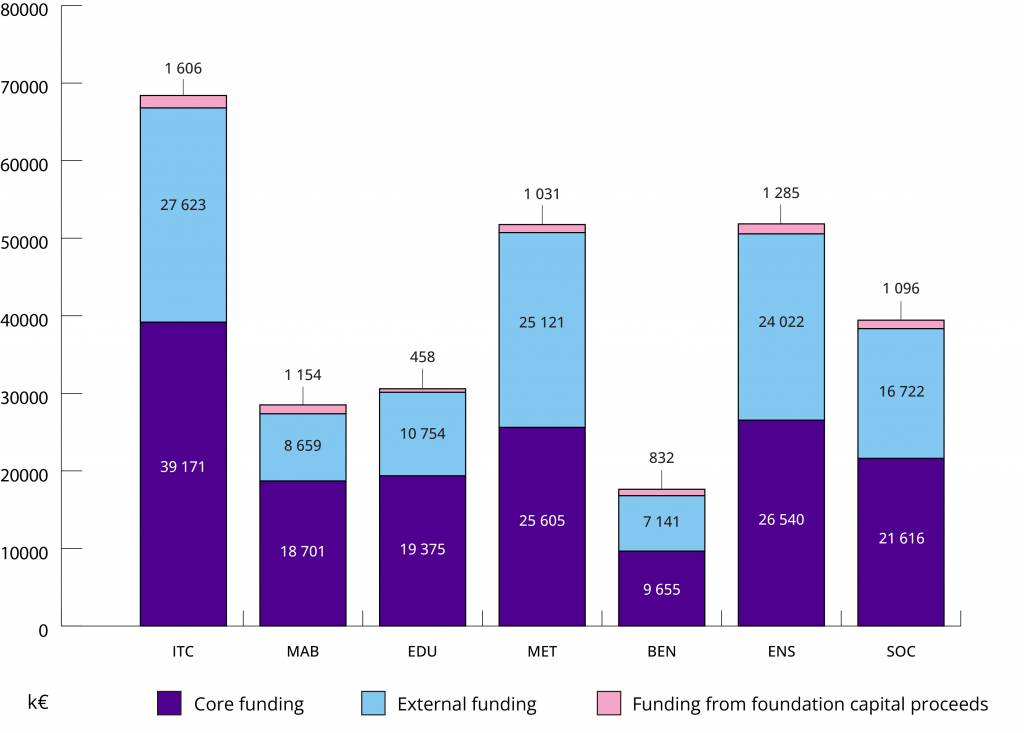

Faculties’ total funding 2022 (M€)

Faculties’ funding 2022

Personnel costs decreased, rent and electricity expenses increased

The expenses of ordinary operations totalled EUR 350.9 million. Personnel costs decreased from the previous financial year by EUR 8.3 million to EUR 222.8 million. The decrease was mainly due to a decrease in the number of personnel in support services. Due to index-based increases, rental expenditure increased by EUR 1.4 million to a total of EUR 40.9 million. The rise in the price of electricity increased expenses by EUR 0.8 million. The recovery from the pandemic was reflected, for example, in the significant increase of travel and catering costs.

The University’s result from ordinary operations excluding non-recurring items was EUR -9.8 million. The result of ordinary operations adjusted for non-recurring items and capital allocations was EUR -4.6 million.

The recovery from the pandemic was reflected, among other things, in the significant increase of travel and catering costs.

Income and expenditure 2022 (M€)

Fall in the investment market weighed on the market value of portfolio

The market value of the investment assets of the Tampere University Foundation sr, which operates as Tampere University, was EUR 436.8 million on 31.12.2022. As a result of the sharp decline in the investment market in 2022, the market value of the investment portfolio decreased by 7.5% from the previous year. Despite the decrease in market value, the return of the foundation’s investment portfolio exceeded the return of the benchmark index defined in the investment plan by 0.3 percentage points. The result of the investment and financing activities, based on market values on 31 December 2022, was EUR -34.1, resulting in an overall loss of EUR -39 million for the financial year of 2022 (result adjusted for non-recurring items and allocated capital).

The Foundation’s investment activities are based on a long-term approach and broad diversification. From the start of Tampere University’s operations on 1 January 2019, the nominal yield of the investment portfolio has been EUR 95.7 million.

The foundation’s investment activities are based on a long-term approach and broad diversification.

In 2022, returns on the foundation capital were allocated from restricted funds and the development fund set up at the end of the previous financial year to strengthen research, education, and international operations in line with the University strategy.

The Tampere University Foundation Group

The consolidated financial statement of the Tampere University Foundation Group includes, in addition to the parent company, the subsidiaries Tampere University of Applied Sciences Oy (87.0% ownership), Campusta Oy (100% ownership), which provides facilities services, and Radio Moreeni Oy (100% ownership).

Tampere University Foundation has a participating interest in the affiliated companies Finnish Vaccine Research Finvac Oy (49.0%), Tuotekehitys Oy Tamlink (24.8%) and Funidata Oy (22.4%). The Foundation also has other significant ownerships in University Properties of Finland Ltd (14.4%) and Certia Oy (13.8%).

In the financial period, income from ordinary operations of the Group totalled EUR 416.2 million. Together, Tampere University and Tampere University of Applied Sciences received a total of EUR 254.8 million in government funding, which showed a decrease of EUR 2.6 million from 2021.

The Group’s income from ordinary operations totalled EUR 416.2 million.

The Group’s total expenses in the financial year were higher than in 2021. The Group’s personnel costs in the financial year amounted to EUR 280.5 million. The reduction of EUR 6 million compared to 2021 was largely due to the structural changes of Tampere University (the university’s decrease was EUR 8.3 million).

The Group’s loss from ordinary operations for the financial year was EUR -5.3 million. Because of the negative change in the value of investments, the Group’s financial result was EUR 41.1 million in the negative.